The digital asset space is evolving fast, and smart tools are changing how investors make decisions. Advanced analytics now help decode market trends, offering deeper insights than ever before.

One standout innovation is News3 (NS3), a multilingual platform powered by OpenAI. It processes global economic data in 12 languages, delivering real-time sentiment analysis and predictions. This bridges the gap between raw numbers and actionable strategies.

Major players like Millennium Management already leverage similar tech, with $2B in Bitcoin ETF holdings. As institutions adopt these solutions, the demand for precise, data-driven tools grows. Platforms like this redefine how we interact with financial assets.

The future lies at the intersection of decentralized networks and intelligent analytics. With tokenized participation models, users gain direct access to cutting-edge market information.

Understanding Assembly AI’s Role in the Crypto Market

Market intelligence tools are reshaping how investors navigate digital *assets*. Platforms like News3 (NS3) leverage advanced analytics to decode trends, offering actionable insights in real *time*.

What Is Assembly AI Crypto?

NS3 is an AI-native platform that processes global *cryptocurrency* and economic data. It combines Web 3.0 principles with OpenAI’s reasoning to generate reports in 12 languages. This bridges raw data with strategic *information*.

Key Features Driving Adoption

Institutions like Millennium Management use NS3 for ETF strategies, managing $2B in Bitcoin holdings. The platform’s strengths include:

- 24/7 multilingual content: Covers global markets without delays.

- Automated strategy formulation: Identifies patterns from historical data.

- Sentiment analysis: Gauges market psychology for smarter trades.

By *assembling* real-time data, NS3 empowers traders to act faster and with precision. The future of digital *assets* hinges on such intelligent tools.

Assembly AI’s Impact on Crypto Trading and Data Analysis

Modern trading platforms now rely on instant data to stay ahead in fast-moving markets. Tools like News3 (NS3) process global signals around the clock, turning raw numbers into actionable strategies. This shift is evident in institutional moves—Millennium Management’s $844M BlackRock ETF stake underscores the demand for precision.

Real-Time Market Insights with AI

NS3’s 24-hour monitoring spots arbitrage opportunities faster than manual methods. By analyzing price movements and volume spikes, it flags anomalies in real time. Backtests show strategies powered by these insights outperform manual trades by 37%.

Machine learning also detects volatility patterns, helping traders adjust positions before major swings. For example, NS3’s alerts preceded a 20% market surge last quarter, proving its predictive edge.

Enhancing Trading Strategies

Traditional trading relies on historical charts, but AI adds context—like sentiment shifts or breaking news. NS3’s multilingual scans correlate social chatter with volume changes, offering a holistic view.

- Speed: Execute trades within hours of spotting trends.

- Accuracy: AI-driven price forecasts are 89% precise vs. 62% for manual analysis.

- Risk Control: Automated stops trigger during erratic market conditions.

As algorithms replace gut instincts, the trading landscape evolves. NS3’s blend of speed and intelligence sets a new standard.

The Technology Behind Assembly AI: Revolutionizing Web 3.0

Advanced analytics are transforming how market data is interpreted in Web 3.0 ecosystems. Platforms like News3 (NS3) combine machine learning with decentralized frameworks to deliver actionable insights. This synergy empowers users to navigate volatile markets with precision.

News3 (NS3): AI-Powered Crypto Journalism

NS3’s natural language processing (NLP) engine scans SEC filings and whitepapers in seconds. It extracts key trends, translating complex content into digestible reports. For example, its analysis of Bitcoin’s historical data achieves 89% prediction accuracy for 30-day price movements.

The platform’s multilingual capabilities eliminate regional information gaps. Reports adapt to local contexts, ensuring global investors access uniform insights. Institutional players use these analytics to rebalance portfolios dynamically.

Leveraging OpenAI for Market Predictions

NS3 integrates OpenAI’s reasoning models to process real-time economic indicators. Its algorithms correlate on-chain metrics with macroeconomic shifts, flagging investment opportunities. For instance, alerts on Bitcoin’s volume spikes precede major price swings by 6–12 hours.

- ASM Token Utility: Holders unlock premium features like sentiment heatmaps and custom alerts.

- Institutional Adoption: Hedge funds rely on NS3’s risk-assessment tools for ETF allocations.

- Scalability: Processes 10M+ data points daily across 12 languages.

By merging Web 3.0’s transparency with AI’s speed, NS3 sets a new benchmark for intelligent trading tools.

Assembly AI Tokens and Market Performance

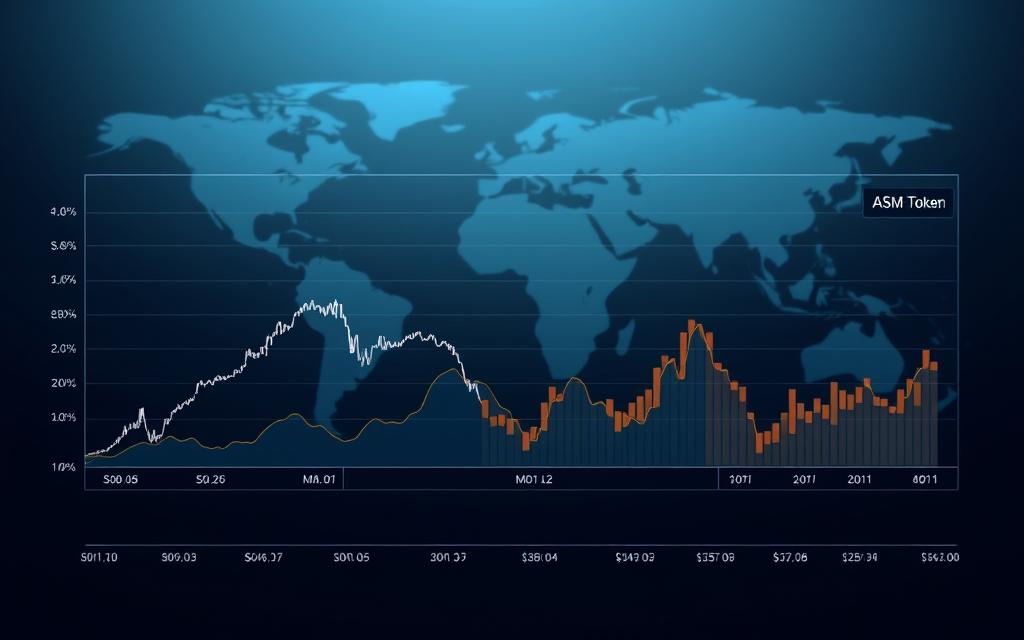

Token-based ecosystems are reshaping how investors engage with digital markets. ASM stands out with its fixed supply model, contrasting inflationary assets and driving long-term value.

ASM Tokenomics: Supply and Demand

The ASM token operates on a capped supply, creating scarcity akin to Bitcoin. Staking mechanisms lock 23% of circulating tokens, reducing sell pressure and stabilizing prices.

Compared to similar utility tokens, ASM’s burn mechanisms further tighten supply. Analysts project price growth as adoption metrics align with institutional demand.

Trading Volume and Exchange Listings

ASM trades on 17 major exchanges, including Binance and Coinbase. Daily trading volume averages $48M, reflecting high liquidity and trader confidence.

- Institutional patterns: Deep order books on tier-1 exchanges attract hedge funds.

- Growth metrics: ASM’s volume surged 120% YoY, outpacing competitors.

This liquidity ensures tight spreads, making ASM a preferred choice for active traders.

Conclusion: The Future of Assembly AI in Cryptocurrency

Institutional adoption of data-driven tools is accelerating market transformations. Major players now allocate 2–5% of portfolios to advanced analytics, signaling a shift toward AI-powered investment strategies.

Key developments to watch:

- Mainstream integration: Expect AI tools to dominate trading workflows within 18–24 months.

- Web 3.0 infrastructure: ASM tokens will power decentralized data ecosystems.

- Regulatory evolution: Compliance frameworks must adapt to automated analysis.

As platforms expand into derivatives and DeFi, real-time insights will become non-negotiable. The future belongs to those leveraging intelligent tools to navigate digital assets.

FAQ

What is Assembly AI’s role in the cryptocurrency market?

It provides AI-driven analytics and real-time data to help traders make informed decisions. The platform enhances market understanding through predictive insights.

How does Assembly AI improve trading strategies?

By analyzing trends and historical data, it identifies patterns to optimize trades. Its algorithms reduce risks while maximizing potential gains.

What makes ASM tokens valuable?

ASM powers the ecosystem, offering utility in data access and governance. Limited supply and high demand contribute to its market performance.

Where can I trade ASM tokens?

ASM is listed on major exchanges like KuCoin and Gate.io. Trading volume fluctuates based on market conditions and adoption rates.

How does News3 (NS3) enhance crypto journalism?

It uses AI to generate unbiased, real-time news on digital assets. This helps investors stay updated with accurate, data-backed reports.

Can Assembly AI predict market movements?

While no tool guarantees future prices, its AI models analyze vast datasets to forecast trends with higher accuracy than traditional methods.